The theme for Earth Day 2022 is Invest in Our Planet, a call for governments, businesses and individuals to invest in a better future for the planet.

Brands across the board are increasingly coming up with innovative, creative ways for consumers to contribute in protecting our planet. Trade-in programs, easy and free recycling services, incentives and discounts, are all aimed to demonstrate their commitment to sustainability, also helping educate upcoming generations on the important role we play to preserve Mother Earth. No longer just a trend, companies are finding new ways to reduce their carbon output, turning to investments in carbon offset programs to decrease their carbon footprint.

While we're seeing progressive change and awareness, the unfortunate reality points to the need to do more. In 2021, industry affiliated greenhouse gas (GHG) emissions grew by 6.2%, faster than the country’s GDP, which rose 5.7% the same year, as reported by the Rhodium Group.

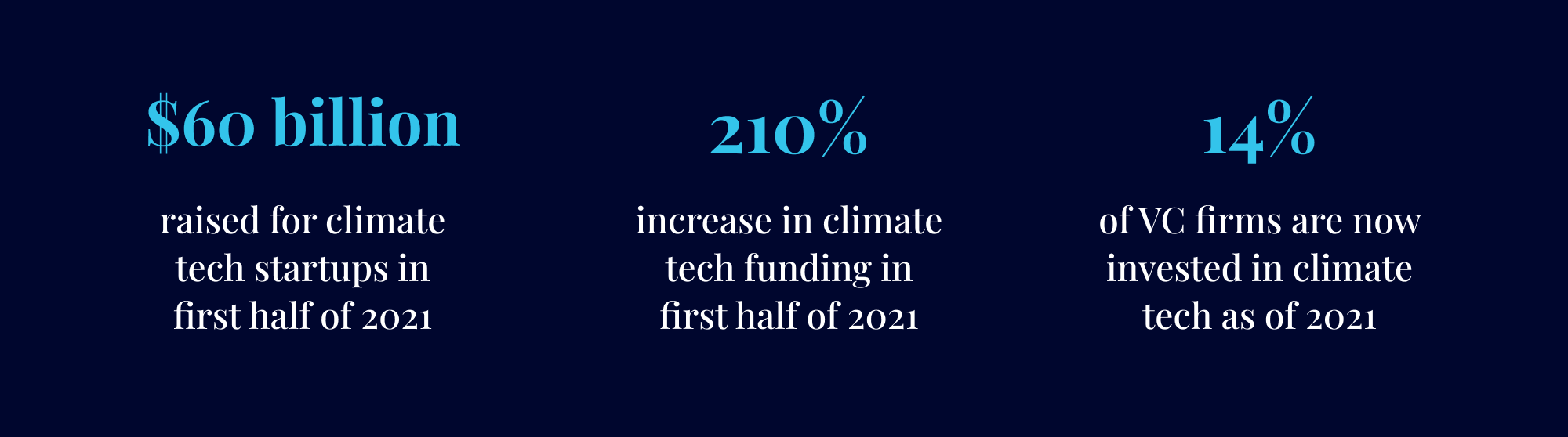

Climate tech solutions and startups are also on the rise, attracting strong investor interest. According to the State of Climate Tech 2021, during the first six months of 2021 alone, climate tech startups saw a 210% surge in funds exceeding $60 billion in raised funding.

Additionally within the last year, 14% of venture capital funds have been invested in environmental technology. From electric vehicles to agriculture and carbon capture, VC firms are leaning into value-based investments in 2022. Meet 4 of the top environmentally conscious venture capital firms dedicated to investing in our planet and driving change.

Buoyant Ventures

Buoyant Ventures is a female-founded and led venture capital firm investing in early-stage environmentally focused startups. Buoyant invests in breakthrough green technology that is transforming how companies alleviate climate change. Their thoughtful investment strategy is focused on innovative solutions that aim to adapt risk, meet climate goals, and enable the future across energy, mobility, built environment, and agriculture and water industries.

Founded: 2019

Location: Chicago, Illinois

Notable Investments: Raptor Maps, Floodflash, StormSensor, SupplyShift

Clean Energy Ventures

Clean Energy Ventures is an early-stage fund started by a dynamic trio of entrepreneurs with backgrounds in energy, startups, engineering and investing. Clean Energy Ventures has a robust portfolio of startups that are leveraging energy technology to combat climate change. Beyond funding, they support their portfolio companies with leadership coaching, strategic marketing, IP and technology enhancement, and board management, industry connections, and growth planning - adding incredible value to help companies on their path to grow and scale successfully.

Founded: 2017

Location: Boston, Massachusetts

Notable Investments: Spark Meter, Boston Materials, Clear Flame

Better Ventures

Better Ventures invests in mission-driven, emerging startups and founders redefining the future through a variety of sustainable initiatives. From companies working to decarbonize the economy, improve human health, and build an equitable society, Better Ventures enables pre-seed to seed stage companies to create purpose and profit by leveraging scientific breakthroughs and emerging technologies to drive real impact.

Founded: 2010

Location: Oakland, California

Notable Investments: Pluton Biosciences, 54Gene, Avalo

Powerhouse Ventures

Powerhouse Ventures is investing in startups that are building out innovative technology to accelerate decarbonization. Prominently backed by industry leading women, Powerhouse Ventures is demonstrating a radical shift in global energy and mobility systems software. As a female founded venture capital firm that works with portfolio companies engaging in environmentally complex issues, Powerhouse Ventures is creating a more equitable space for diverse founders to make their mark on the future of sustainability.

Founded: 2018

Location: Oakland, California

Notable Investments: Sust Global, Finite, Renewafi, Sparkmeter

It’s ever more important for companies, venture capital, and all of us to invest in our planet, together.

Whether you’re building a cutting edge company or solution to help others adopt sustainable practices, or a venture capital firm looking to expand your ‘green’ portfolio, learn how Hunt Club can drive meaningful, trusted introductions to like-minded talent to accelerate your mission and growth.