Market Hiring Report

February 2023

Recent news has focused heavily on the specific hiring practices of tech’s influential market which represents 3% of the U.S.’s total job pool. While these layoffs are newsworthy and tend to make eye-catching headlines, this focus on tech alone neglects the performance of the economy at large and it is important to look at the bigger picture.

The Big, Scary Tech Layoffs Aren’t As Scary As You Think

At Hunt Club, we view these workforce reduction trends as a healthy rebalance in the job market’s natural hiring cycle and not a widespread downturn in the U.S. labor market as a whole.

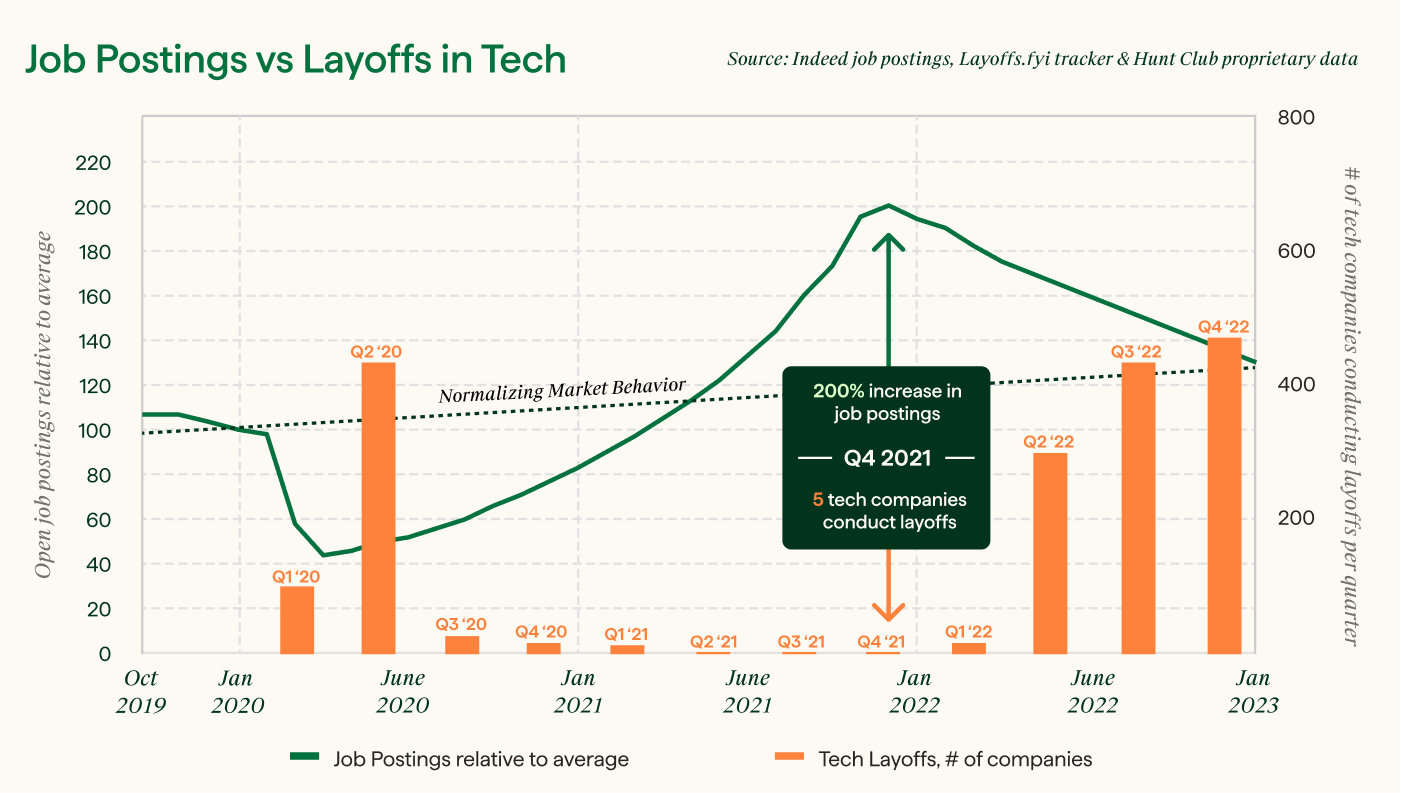

As the data above indicates, we are returning to pre-covid hiring markets which are less volatile and more predictable. The last couple of years have seen dramatic swings in the hiring market – the covid shock, the great resignation / rehiring, and now the layoff period. You can see these behaviors reflected in this chart, which compares public job postings at tech companies with the number of tech companies that experienced mass layoffs.

In 2021, we saw a BOOM in hiring! Tech companies were well-funded, job postings doubled, and the talent market became highly competitive. It was widely accepted as a “candidate’s market” and tech companies were willing to pay top dollar, and often times more, for candidates. Because of these market conditions, Hunt Club saw candidates negotiate up ~28% on their offers compared to previous years. Demand was much higher than supply, plain and simple.

Adding Context to the Media Story: Tech Workforce Reductions Are a Recalibration and Rebalance

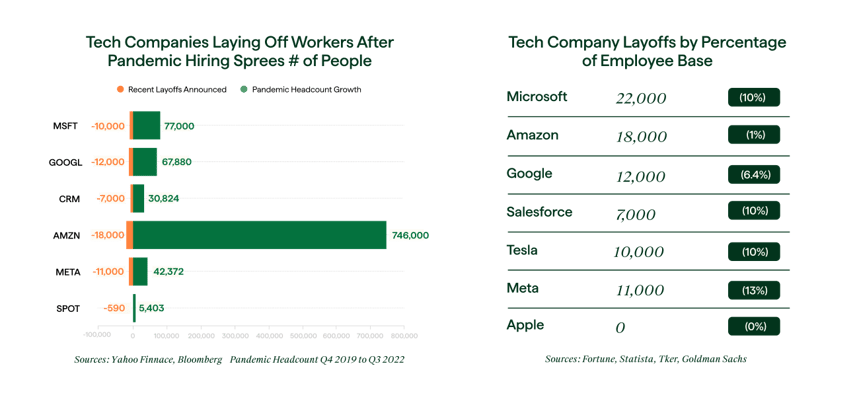

As 2022 rounded out, many tech companies either paused hiring in Q3 & Q4 or had reductions of 5-10% of their workforce. The context largely omitted in those reports was that these tech companies had major hiring spikes during the pandemic and are now using Q1 in 2023 to execute a rebalance of their talent needs.

This is a period in the market’s natural cycle and isn’t something to be feared. It is important for your business to stay the course and ride out this part of the cycle by allocating hiring spend specifically to the most critical functions and roles in your organization.

"The media's portrayal of doom and gloom in 2023 undermines the resiliency of tech companies and the extraordinary funding they raised over the past two years. Many growth-stage companies have incredible balance sheets right now, with a runway to ride out the next 24-36 months until the market is normalized. For these organizations, headcount cuts have primarily been based on performance reductions due to over-hiring in 2022 and the need to optimize for strategic growth.”

Nick Cromydas, CEO at Hunt Club

Employers Are Taking Advantage of the Market to Snap Up Top Tech Talent

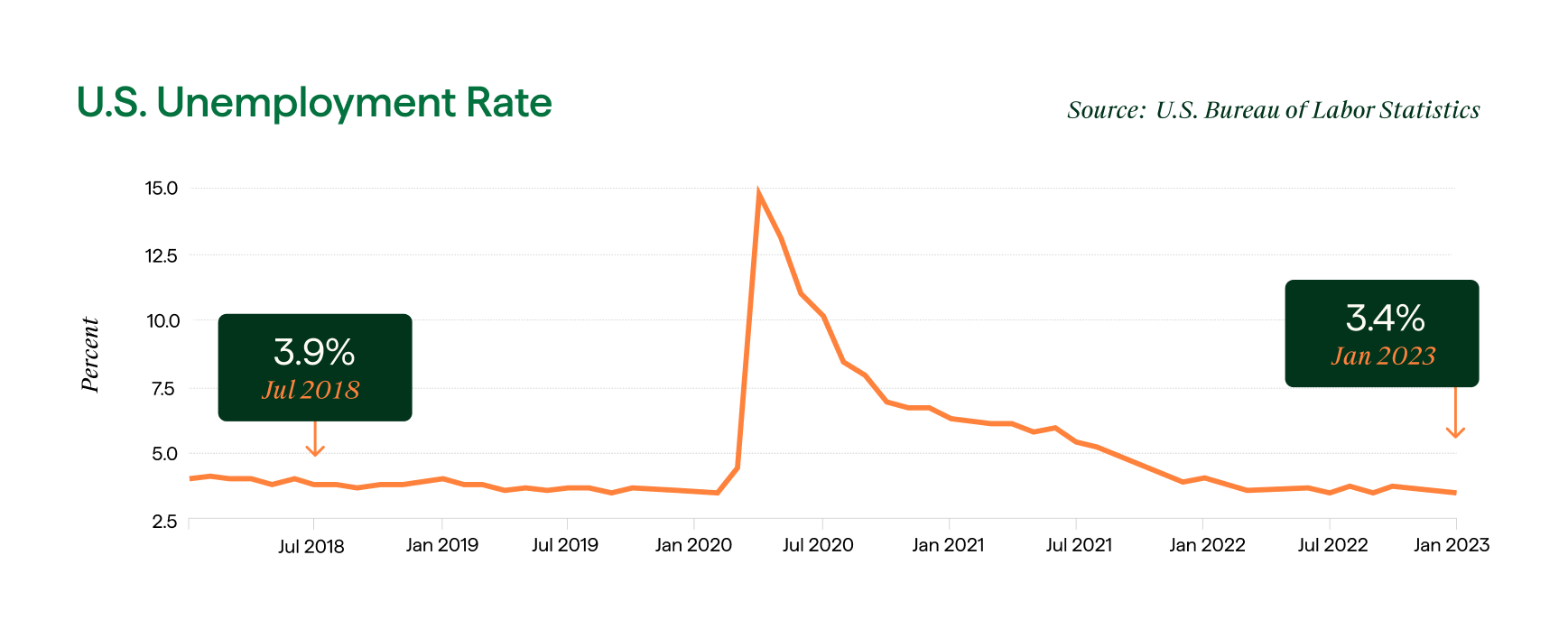

Total non-farm payroll employment rose by 517,000 in January, and the unemployment rate dipped to 3.4% overall, the U.S. Bureau of Labor Statistics reported on February 3rd.

In addition to a low national unemployment rate, another impactful piece to understand is the quick reabsorption of displaced tech talent. While certainly unfortunate for those impacted by layoffs, Hunt Club data shows a majority of these talented workers are finding new jobs in sub 90 days. These numbers indicate an overall stronger-than-perceived market condition and that companies are continuing to prioritize growth despite what’s being reported.

Companies Are Hiring More Tactically

As we enter 2023, the hiring market is returning to a “steady state” reminiscent of pre-covid levels. While the media focuses on layoffs, in actuality there are tons of companies hiring right now. They are just being more strategic about the roles they hire, prioritizing leadership hires to help navigate through change cycles.

According to recent Hunt Club hiring data, our clients are focusing on the most vital areas of their business, including growth, improved product offerings and user experience, and customer success with these roles:

- Executive level (CxO & VP)

- Technical (Product & Engineering)

- Customer-facing positions

We expect this trend to persist for the first half of 2023. A key takeaway for hiring mangers is that the power dynamics are shifting back from a “candidate market” to an “employer market,” which is an optimal time to negotiate and hire important leaders to move your organization forward.

Let's Talk Hiring Trends

Whether you're looking to find your next leader or your next opportunity, our team of Talent Advisors are here to talk all things talent.